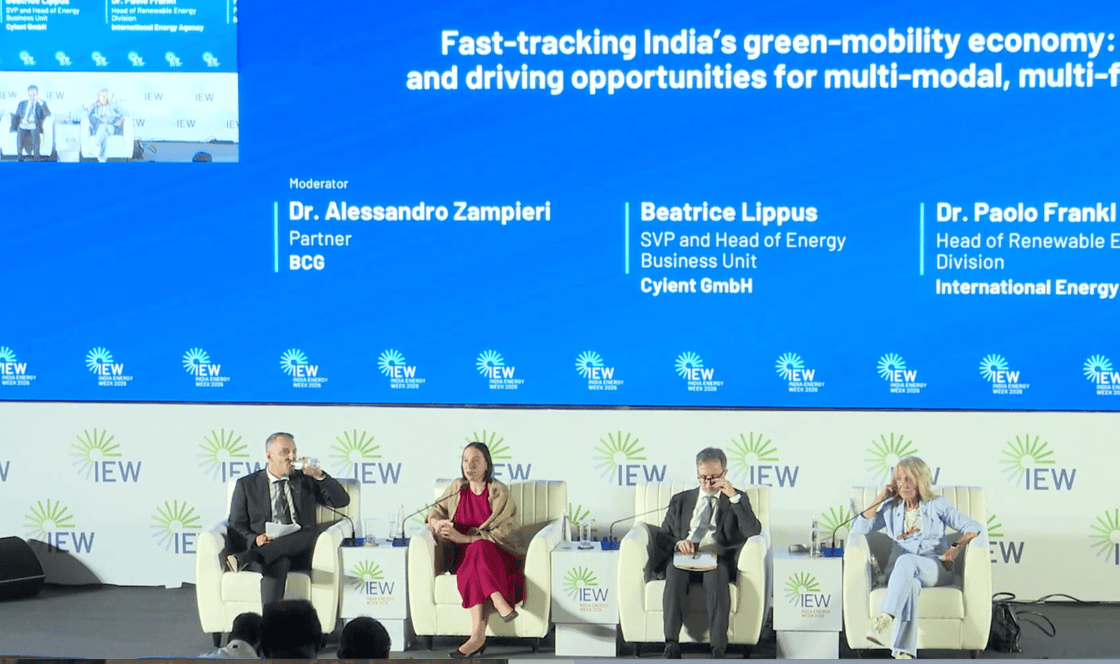

That was one of the takeaways during India Energy Week 2026, which heard Beatric Lippus, Head of Energy Business Unit at an engineering and technology solutions firm Cyient, discuss the company’s involvement in a Norwegian project.

Cyient was awarded a contract to support the development and execution of Green H and Luxcara’s 20MW green hydrogen plant in Bodø, which aims to produce 3,1000 tonnes of hydrogen for ferry operations in fjords.

“The electrolyser facility is in development, and it will provide pressurised hydrogen directly from the factory to the vessel, for bunkering,” she said.

“It is still at a relatively early stage, there’s a lot of exploration that needs to be done. But we strongly believe that if the electrolyser efficiency can be improved, there is significant potential.”

However, she stressed projects like this could help inform the design, execution, and operation of projects in India.

“India has gained a lot of expertise, developing projects and solutions for different countries, and if we bundle that knowledge and use it for India, that will heavily accelerate [the industry],” Lippus said.

Dr Paolo Frankl, Head of Renewable Energy Division at the International Energy Agency, said hydrogen is at the beginning of a long journey. India is targeting an annual production of five million metric tonnes of green hydrogen by 2030.

However, that goal has come under question amid global policy delays as Indian project look to export green molecules overseas.

“At the IEA we say hydrogen has three priorities – demand, demand and demand,” Frankl told the event. “There has been a lot of emphasis on the technology push, but not on predictable demand creation and who pays the extra cost. I don’t think there’s a problem with a lack of finance, but there is with allocation.”

“What matters is how we form prices and how the burden of extra costs of new technologies are allocated. It’s the risk-benefit ratio. If there’s not a predictable policy framework, that’s difficult, and the financial sector immediately goes somewhere else where it’s lower.”

“But there is a clear shift from fossil fuels to clean energy technology, which is dominated by what’s happening in China. If you look at the LNG deployment story, the key point was when some countries – notably Japan – had the good idea to get the suppliers and demand together, because the energy investments are long-term. The only way is to make something more predictable – then the investors will come.”