The company stated that debt terms are advanced but remain conditional on the closing of the $630m project’s equity package, with a “motivated consortium” still being finalised.

Atome said lenders are providing “very competitive terms,” with definitive loan agreements now in the final stages of negotiation.

However, the firm stressed that execution of those agreements depends on completing the project’s equity funding, which is still being assembled.

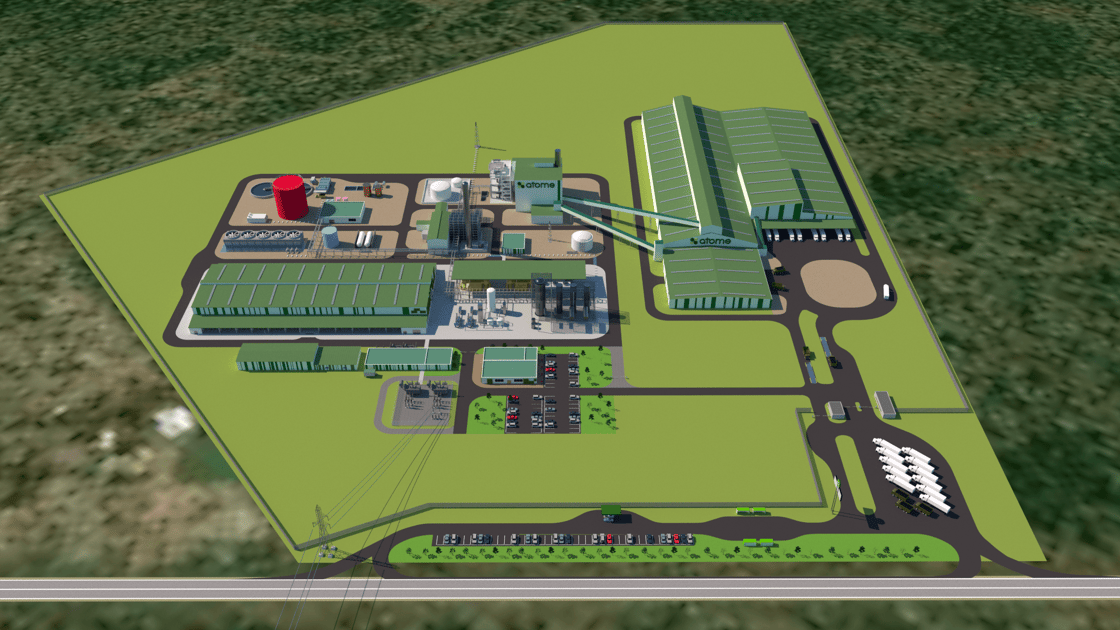

CEO Olivier Mussat said the financing processes would be a “pioneering” effort for the world’s first industrial-scale green fertiliser plant.

He added, “While coordinating top-tier global partners across three continents is complex, the time invested now ensures we are building the most robust financial foundation possible for the project’s lifespan and sets the blueprint for future projects.

“We are maintaining our challenge to our financing partners to achieve FID in or about the end of this year and working with them 24/7 to achieve this goal. We will keep the market informed.”

The update comes shortly after Atome secured up to $200m in debt support from IDB Invest and a further $100m in debt and equity financing from the International Finance Corporation (ICF).

The packages are expected to form the backbone of the Villeta project’s capital structure, but the company has yet to complete the equity portion required for full financial close.

Stay ahead with a H2 View subscription

Gain access to the insights, data, and analysis trusted by hydrogen professionals worldwide.

With a H2 View subscription, you get:

- Unlimited access to 15,000+ articles

- Monthly digital magazine + H2 Review

- Exclusive interviews, webinars and reports

- Expert analysis shaping the hydrogen conversation