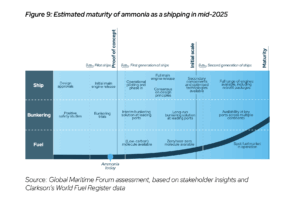

While ammonia is ready for piloting in shipping and methanol for low-carbon operations, both require a concerted push if they are to be mature enough to rapidly scale from around 2030, in line with industry targets, the From pilots to practice: Methanol and ammonia as shipping fuels report notes.

It finds the key area to be addressed is the fuel supply chain – in the case of methanol, enhancing the availability of green molecules; for ammonia, validating and rolling out commercial ammonia bunkering at key ports.

Jesse Fahnestock, Director of Decarbonisation at the Global Maritime Forum, said we have seen excellent progress in the development of zero-emission fuels and technologies over recent years, with methanol and ammonia having now shifted from potential solutions towards initial scale and proof of concept.

“However, we are only at the start of our journey and technology readiness is not enough by itself,” he said. “To scale zero-emission fuels at the pace required, we need action from the International Maritime Organisation, national policymakers and the industry to create the right enabling conditions; this will be just as vital as the development of the technology itself.”

Operators report confidence in safely operating ammonia-powered vessels and will likely phase the fuel in over time to build operational experience. Engine tests suggest it can cut tank-to-wake emissions by up to 95%.

Safety concerns persist however. Interviews with shipowners and operators suggest that significant changes are needed in the design of safe ammonia-powered ships to effectively manage the fuel’s toxicity. This includes segregating sections for leak management and a package of safety measures and technologies, such as extra gas detectors, automatic shutdown, double-wall piping, water sprays, and refrigeration.

Methanol is rapidly moving from proof of concept to early scale with more than 60 methanol-capable vessels in operation, 300 more on order, and bunkering available at around 20 ports, and early adopters are finding it relatively safe and straightforward to integrate.

Its lower energy density presents operational trade-offs but has not proven a barrier, and new retrofit kits and the relative ease of converting tanks are making retrofitting conventional vessels feasible.

The key challenge to broader scale-up is the availability of green methanol, which makes up only a small share of total supply and remains challenging for shipping companies to access.

New mandatory regulations for using hydrogen and ammonia fuel in ships are unlikely before 2028 at the earliest, according to a white paper by ships classification organisation DNV issued in March.

This month saw Grimaldi Group receive its first ammonia ready ship and last month Japan general trading company Itochu Corporation signed a shipbuilding contract for a 5,000 cbm ammonia bunkering vessel with Sasaki Shipbuilding Company, with delivery slated for 2027.

China’s Envision Energy recently reported that green ammonia fuel produced from its green hydrogen and ammonia plant in Chifeng has successfully powered the first green marine ammonia bunkering operation.

Fortescue, Trovio, and the Green Hydrogen Organisation (GH2) recently issued the “world’s first” digital fuel certificate for an ammonia-to-ship transfer at the port of Rotterdam.