The IDB Invest package comprises senior debt, blended finance, and a letter-of-credit-backed reserve facility.

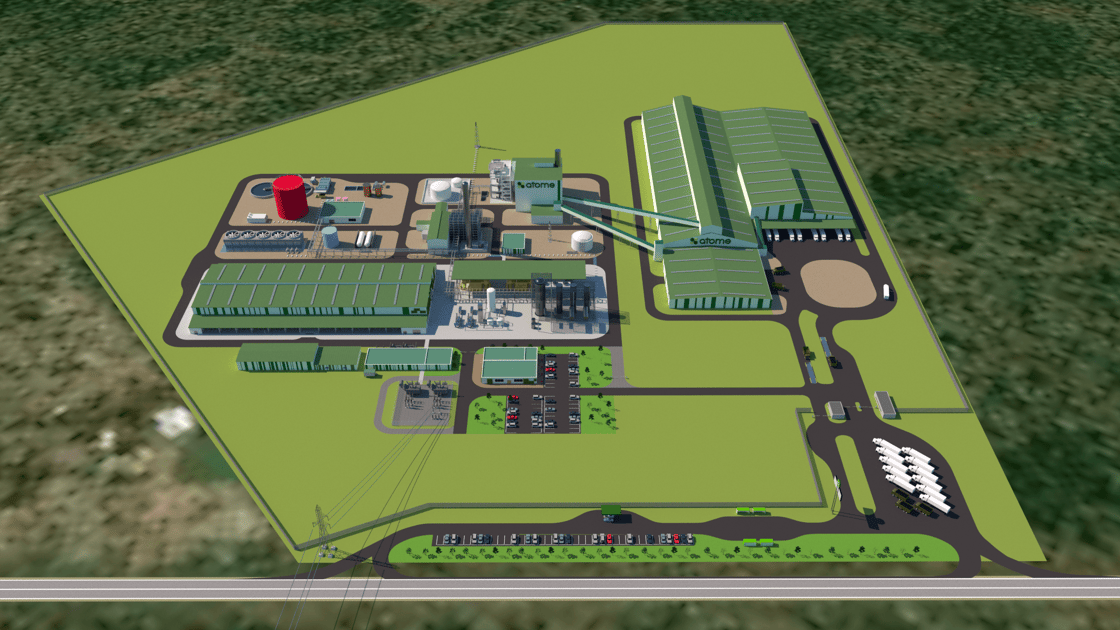

The funding will form a critical part of the $630m Villeta project, which will use green hydrogen to produce around 260,000 tonnes of green calcium ammonium nitrate per year.

Fertiliser major Yara has already agreed to offtake the plant’s total output under a 10-year deal.

The IDB Invest package is conditional only on the finalisation and execution of agreed debt and project documentation, as well as the closing of the project’s equity package at financial close.

Last month Atome secured up to $100m in debt and equity financing from the International Finance Corporation for the development.

The company expects to reach a final investment decision (FID) this year, with Swiss engineering firm Casale lined up to deliver the project under a $465m EPC contract.

The Villeta project has been years in the making and would represent a significant milestone for clean fertilisers and green hydrogen production.

Atome CEO Olivier Mussat previously told H2 View that global food and beverage companies are increasingly willing to pay a premium for low-emission fertilisers as they seek to cut real emissions rather than rely on offsets.

Reach the global hydrogen audience

Put your brand at the heart of the hydrogen conversation. With H2 View, you can reach decision-makers and professionals across the global hydrogen value chain.

Our 2026 Media Guide shows how you can:

• Advertise across digital, print, and newsletters

• Connect with a highly engaged hydrogen audience

• Align your company with trusted industry coverage

Download H2 View’s Media Guide today