The European Commission’s rules mean that just 25% of electrolyser stacks used in projects securing EHB funding, including cell unit production, stack assembly, and surface treatment, can be sourced from China.

Having previously warned that the criteria was unclear, HydrogenPro said the rules would drive up green hydrogen project costs and further impede project development.

Read more: EU restrictions on Chinese electrolysers may hike green hydrogen costs, says HydrogenPro

In a statement released on November 15, the company said, it had observed uncertainty and misunderstandings of the “complex supply chain involved in the production of electrolysers.”

Having reviewed a letter by the Commission, the statement continued, “HydrogenPro fully complies with the EHB’s funding requirements for our European projects. Any necessary adjustments to our supply chain will be minimal.”

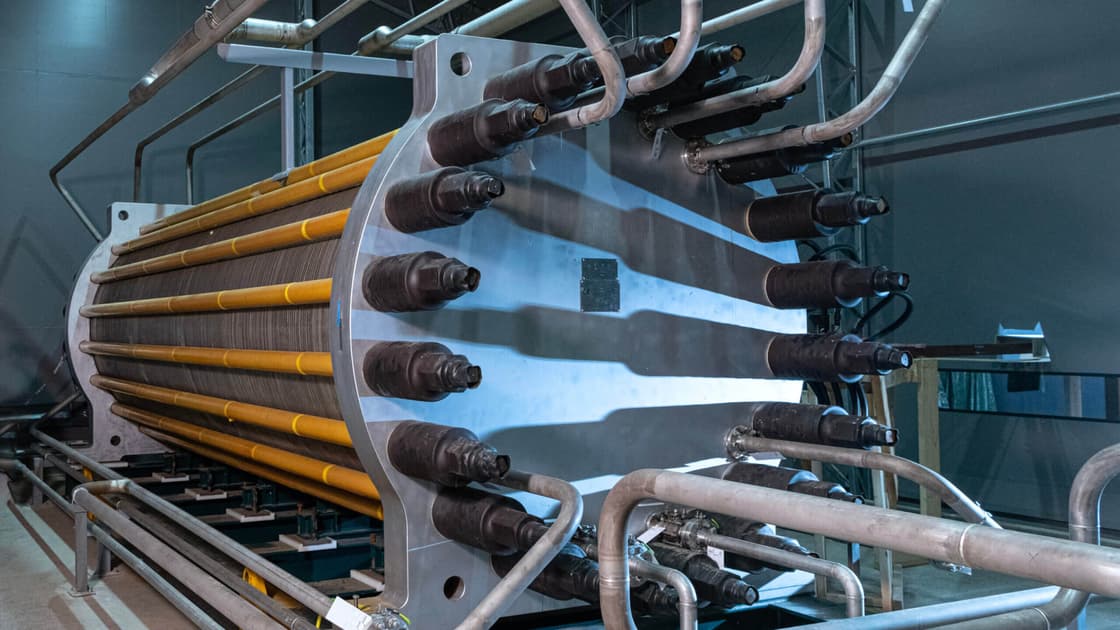

CEO, Jarle Dragvik, added, “We have thoroughly analysed our supply chain based on the EU regulations, which includes our electrode production in Denmark and assembly at our collaboration and EPC partner ANDRITZ AG’s site in Germany, and we are confident we will comply with all regulations.”

Introduced to ensure domestic European manufacturers can compete against far cheaper Chinese electrolysers, HydrogenPro, which boasts 500MW of production capacity in the People’s Republic, was outnumbered by those calling for criteria.

The likes of Nel, Siemens, thyssenkrupp nucera and more putting their names to a letter sent to the European Commission warning of the “acute threat” posed by Chinese OEMs, the EU’s climate chief, Wopke Hoekstra, said that China was oversupplying electrolysers at “ever-lower costs.”

Europe’s hydrogen ambitions tested: Can electrolyser OEMs compete?

© Hydrogen Europe

The threat of a European electrolyser industry wipeout is real and could happen faster than it did in the solar PV market without proper policy intervention, warned Hydrogen Europe CEO, Jorgo Chatzimarkakis, in an interview with H2 View.

His comments come amid what appears to be a widespread crisis across the EU’s clean technology manufacturing industries, which face stark competition from often state-subsidised companies in China that offer far lower-cost products.

In recent months, the EU solar manufacturing industry reached its tipping point. After sustained calls for help, early 2024 saw solar players warn of bankruptcy, production pauses, factory closures and debt restructuring. In March, Swiss-based Meyer Burger shut the doors of its German solar module factory in Freiburg.

The overarching message from the solar companies at the centre of the storm: low-priced Chinese modules are distorting competition and exacerbating market pressures.

Solar Industry Regions Europe (SIRE), in a position paper, claimed an oversupply of imported PV modules – often supported by Chinese subsidies – drove prices below EU production costs.

China currently supplies over 80% of EU solar imports – while the bloc reportedly produced just 3% of its solar panels in 2023.

Against that backdrop, Chatzimarkakis believes the threat of a Chinese rivalry could have a similar effect on electrolyser original equipment manufacturers (OEMs) and much more quickly, due to delays in the ramp-up of the hydrogen market.

“The electrolyser industry is facing a period of consolidation where smaller actors, especially the pure-play hydrogen technology companies, will face existential challenges. It is generally expected that many companies will not be able to survive the next five to seven years…

Click here to keep reading.